香港1997年-2020年回归

7月1日,在香港回归祖国怀抱23周年的纪念日,国家税务总局广东省税务局给大家带来了一个好消息:

粤港澳大湾区个人所得税优惠开始受理补贴申请了!境外人才享受内地个人所得税财政补贴也将会更加便捷!广东税务近日在税务总局自然人电子税务局系统创新推出了粤港澳大湾区人才税e查功能模块(以下简称“税e查”)。

“税e查”可为境外人才申请享受财政补贴计算时,提供便捷的个税缴税数据的在线查询功能。申请人仅需登录并授权“税e查”后,便可自动对接粤港澳大湾区广东大部分地市的网上申报系统,实现个税财政补贴申请全程网上办。

“税e查”主要提供三大便利

1.一是数据查询“更轻松”。

实现中英文对照的一窗式登录、一键查询,轻松获取个人补贴项目涉税数据,解决了大部分境外人才对于境内纳税记录查询不熟悉、填报纳税数据困难的问题;

2.二是补贴范围选择“更准确”。

暂行办法规定的可补贴范围主要包括工资薪金、稿酬、劳务报酬、特许权使用费、经营所得、人才补贴所得六个所得项目,其他个人所得税所得项目不属于本次财政补贴范围。“税e查”框定六项所得范围,获取符合补贴范围的个税缴纳记录,为申请人排除错选、漏选的风险,提高服务效率、降低政策风险。

3.三是纳税数据传递“更快速”。

申请人通过“税e查”获取个人纳税数据后,只要完成线上授权,数据即可传递到补贴办理相关部门,协助快速完成审核计算,及时开展补贴发放工作。

具体操作请见下述

粤港澳大湾区人才税e查操作指引

Tax E-Check Guideline For Talent in Guangdong-Hong Kong-Macao Greater Bay Area

操作步骤

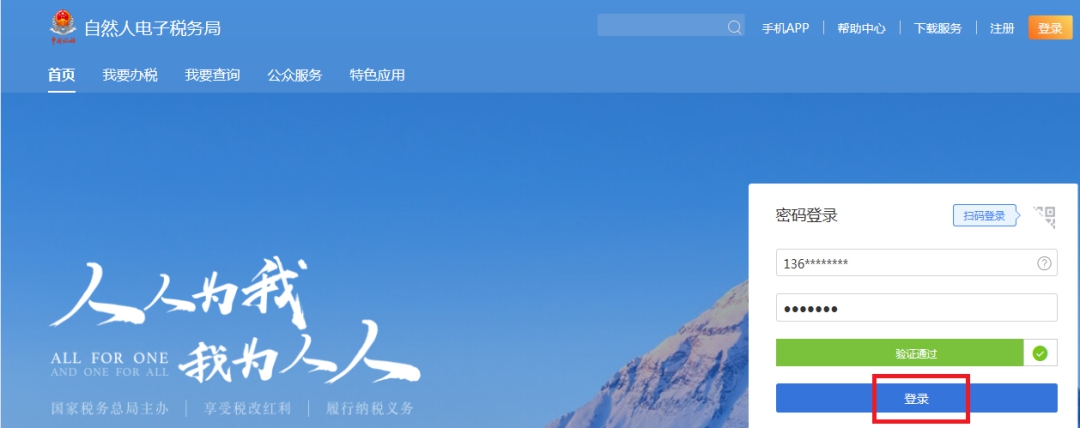

(1)打开自然人电子税务局:https://etax.chinatax.gov.cn/

【Log into the Natural Person Electronic Taxation Bureau system by accessing the following official website: https://etax.chinatax.gov.cn/】

(2)申请人完成注册和实名认证后(具体请参考各地的指引),点击“密码登录”按钮,输入手机号码/证件号、密码,拖动滑块通过验证后点击“登录”按钮;或使用个人所得税APP扫码登录。

【After signing up an account and completing identity verification (please refer to the online instructions on the official website of the local tax authority), choose “log in with a password” or “log in with a QR code”.

Log in with a password - Enter your mobile number/ID number and password, drag the slider to complete the verification and click the “Sign in” button.

Log in with a QR code-Open the Individual Income Tax application in the mobile phone and scan the QR code to log in.】

(3)登录系统后,点击【特色应用】,选择广东省行政区域,进入【粤港澳大湾区人才税e查】。

【Click “Featured Application” button and choose“Guangdong Province” after logging in your account. “Tax E-check of Talent in Guangdong-Hong Kong-Macao Greater Bay Area” could be found on this page. Click this button to access the Tax E-Check system.】

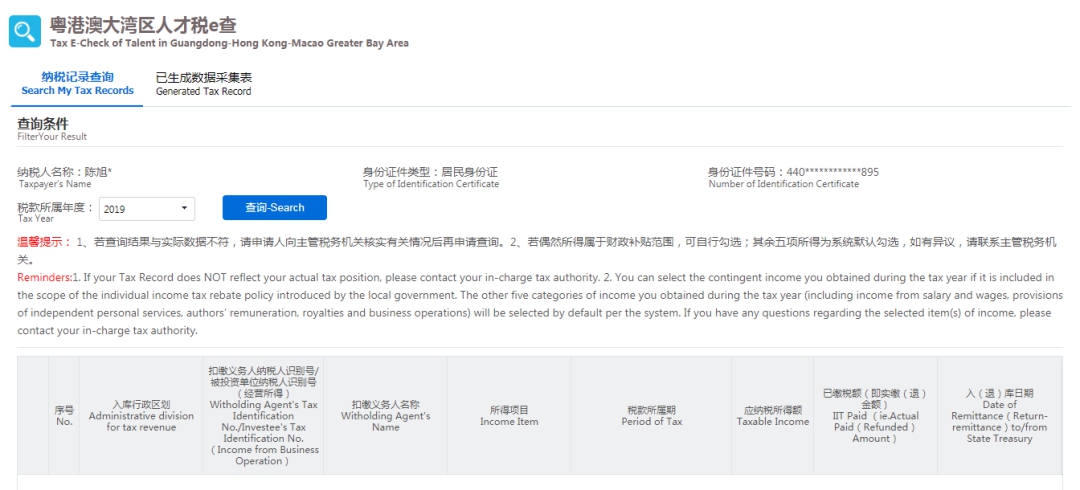

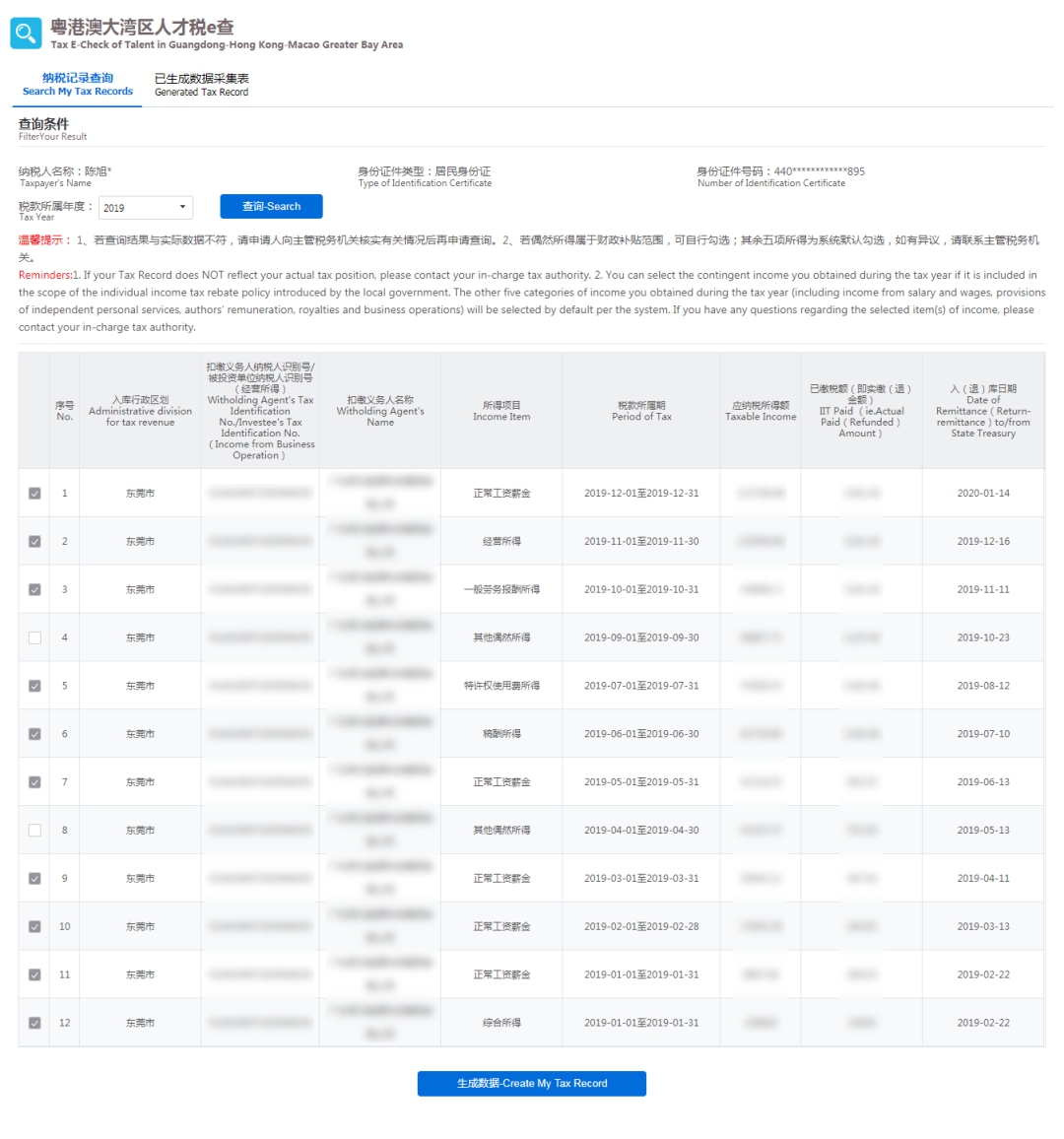

(4)在“纳税记录查询”页面,自动带出当前登录人的名称、身份证件类型、身份证件号码及税款所属年度,点击“查询”按钮,查询个税申报数据。

注:若偶然所得属于财政补贴范围,可自行勾选。其余五项所得为系统默认勾选,如有异议,请联系主管税务机关。

【Go to Search My Tax Record and check your basic information (including Taxpayer’s Name , Type of Identity Certificate, Number of Identity Certificate and Tax Year). Choose “Tax Year” and click the Search button to obtain taxpayer’s income and tax record.

Note: You can select the contingent income you obtained during the tax year if it is included in the scope of the individual income tax rebate policy introduced by the local government. The other five categories of income you obtained during the tax year (including income from salary and wages, provisions of independent personal services, authors’ remuneration, royalties and business operations) will be selected by default. If you have any questions regarding the selected item(s) of income, please contact your in-charge tax authority.】

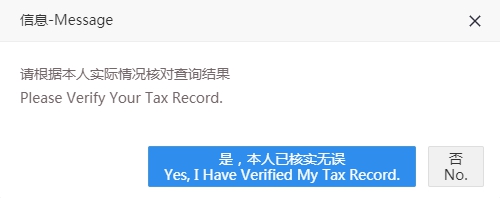

(5)查询结果出来以后,点击屏幕下方的“生成数据”按钮,系统弹出“请根据本人实际情况核对查询结果”,申请人点击“是,本人已核实无误”按钮,然后在弹出的页面根据实际情况填写申请信息;如果申请人点击“否”按钮,系统返回查询结果页面。

【Click the Create My Tax Record button at the bottom of the record data. A reminder “Please verify your Tax record.” will pop up. Click “Yes, I have verified my Tax Record.” and then provide the information needed in the application of the tax record. Click “No.” and the system goes back to the page of the record data. 】

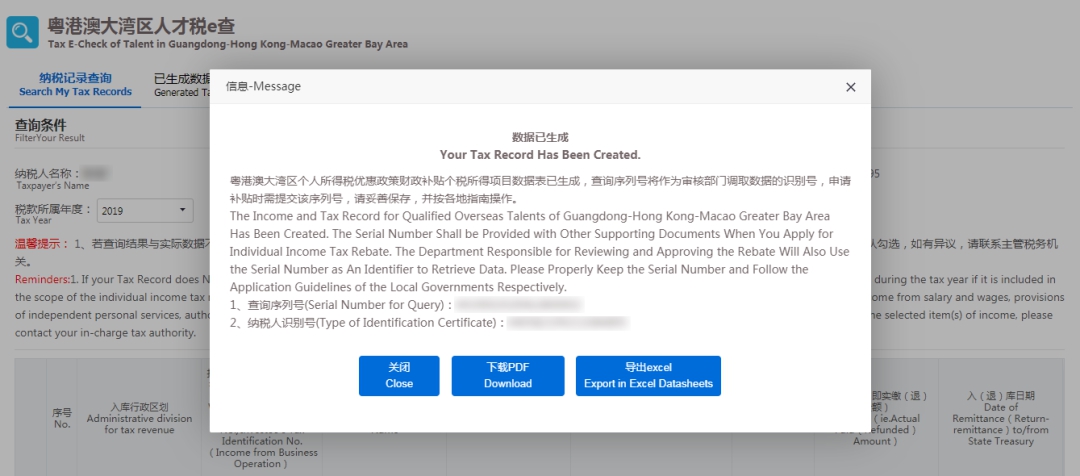

(6)生成数据后,点击“下载PDF”按钮下载PDF文件,点击“导出excel”导出excel文件。如无需下载的,直接点击“关闭”按钮。

【After obtaining your Tax record, choose Download in PDF Format or Export in Excel Datasheets. Click the Close button if you don’t need to download the record.】

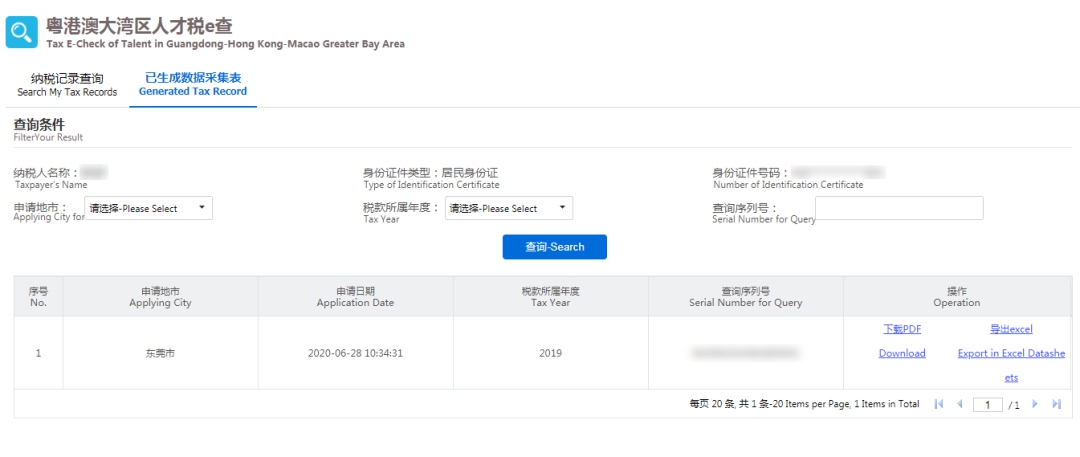

(7)已生成的记录可以在【已生成数据采集表】中查询,可点击操作列中的“下载PDF”按钮下载PDF文件,点击“导出excel”按钮导出excel文件。

【You can find the generated data in Generated Tax Record Module. Click Download in PDF Format or Export in Excel Datasheets to download your E-Tax record.】