-

Step1:Select Country or Region

-

Step2:Select Treaties titleSelect the option

- Treaties title

-

content No relevant information is available. No relevant information is available. -

Select the option

- Treaties title

-

content No relevant information is available.

-

CHINA

CHINA

-

- No relevant information is available.

《Individual Income Tax Law of the People’s Republic of China (2018 Amendment)》

Article 1 A resident individual is an individual who is domiciled in China or who is not domiciled in China but has stayed in the aggregate for 183 days or more of a tax year in China. A resident individual shall, in accordance with the provisions of this Law, pay individual income tax on his or her income obtained inside and outside China mainland.

A non-resident individual is an individual who neither is domiciled in China mainland nor stays in China mainland or who is not domiciled in China mainland but has stayed in the aggregate for less than 183 days of a tax year in China mainland. A non-resident individual shall, in accordance with the provisions of this Law, pay individual income tax on his or her income obtained inside China mainland.

Tax year means the Gregorian calendar year that runs from January 1 to December 31.

《Ministry of Finance and State Taxation Administration Announcement on the Standards of Determining the Residence Time of Non-China-mainland-domiciled Individuals》(Announcement No.34 of the Ministry of Finance and the State Taxation Administration in 2019)

The days of residence in China mainland for non-domiciled individuals in a tax year is calculated based on the number of days of stay in China mainland.If the individual is physically present in China mainland for 24 hours, that day should be counted as a day of residence in China mainland;If the individual is physically present in China mainland for less than 24 hours, it would not be counted as a day of residence in China mainland.

| No. | Entry and departure period | Number of days |

|---|

| Information Reporting Form for Non-resident Taxpayers Claiming Treaty Benefits非居民纳税人享受协定待遇信息报告表 | ||||||||

| Monetary unit: RMB Yuan (Keep two decimal places)金额单位:人民币元(列至角分) | ||||||||

| Non-resident Taxpayers fill in the blanks of item 1 to 17 and take legal responsibility for the authenticity, accuracy and legitimacy of the information.非居民纳税人填写第1项至第17项信息,并对填报信息的真实性、准确性、合法性承担法律责任。 | ||||||||

| 1.Name in Chinese中文名称 | 2.Tax identification number in China (Uniform social credit code)在中国的纳税人识别号(统一社会信用代码) | |||||||

| 3.Name in resident jurisdiction在居民国(地区)名称 | 4.Tax identification number in resident jurisdiction在居民国(地区)的纳税人识别号 | |||||||

| 5.Contact address and zip code in China在中国的联系地址、邮政编码 | 6.Telephone number in China在中国的联系电话 | |||||||

| 7.Contact address and zip code in resident jurisdiction在居民国(地区)的联系地址、邮政编码 | 8.Telephone number in resident jurisdiction在居民国(地区)的联系电话 | |||||||

| 9.Resident jurisdiction居民国(地区) | 10.E-mail address电子邮箱 | |||||||

| 11.The applicable treaty享受协定名称 | 12.Applicable articles of the treaty适用协定条款名称 | |||||||

| 13.Whether the non-resident taxpayer obtained the tax resident certificate issued by the competent tax authority of the other contracting jurisdiction to prove the residence status of non-resident taxpayer for the year or its previous year during which the payment is received非居民纳税人是否取得缔约对方税务主管当局开具的证明非居民纳税人取得所得的当年度或上一年度税收居民身份的税收居民身份证明 | □ Yes是 □ No否 |

|||||||

| 14.Amount of the income with respect to which tax treaty benefits are claimed享受协定待遇所得金额 | 15.Amount of tax reduced or exempted享受协定待遇减免税额 | |||||||

| 16.If the article of dividends, interest or royalties is applied, the policy basis for non-resident taxpayer to be the "beneficial owner" is the □ Article 2; □ Item 1 of Article 3; □ Item 2 of Article 3; □ Article 4; □ Others: Please specify________________ of the Public Notice of the State Taxation Administration on "Beneficial Owner" set forth in Double Taxation Agreements (Public Notice [2018] No.9 of the State Taxation Administration).适用股息、利息、特许权使用费条款时,非居民纳税人为“受益所有人”的政策依据是《国家税务总局关于税收协定中“受益所有人”有关问题的公告》(国家税务总局公告2018年第9号)的: □ 第二条;□ 第三条第(一)项;□ 第三条第(二)项;□第四条;□ 其他:请说明________________ |

||||||||

| 17.I hereby declare: According to the laws, regulations of the other contracting jurisdiction and the article of resident of the tax treaty, I am a resident of the other contracting jurisdiction, the principal purpose of the relevant arrangement and transaction is not to obtain tax treaty benefits. Through self-assessment, I believe that I am in conformity with the conditions for claiming tax treaty benefits, so I will enjoy tax treaty benefits. Therefore, I take due legal responsibilities. I will collect and retain relevant materials for review in accordance with the regulations, and accept the follow-up administration of the tax authority.我谨声明:根据缔约对方法律法规和税收协定居民条款,我为缔约对方税收居民,相关安排和交易的主要目的不是为了获取税收协定待遇。我自行判断符合协定待遇条件,自行享受协定待遇,承担相应法律责任。我将按规定归集和留存相关资料备查,接受税务机关后续管理。 Seal or signature of non-resident taxpayer非居民纳税人签章或签字 Y年M月D日 |

||||||||

| Non-resident taxpayers do not need to fill in the following blanks以下信息不需要非居民纳税人填写 | ||||||||

| 18.Name of withholding agent扣缴义务人名称 | ||||||||

| 19.Tax identification number of withholding agent (Uniform social credit code): □ □ □ □ □ □ □ □ □ □ □ □ □ □ □ □ □ □ 扣缴义务人纳税人识别号(统一社会信用代码) | ||||||||

|

||||||||

| The Form for the Tax Filling Administration concerning Outbound Payment under Service Trade and Their Countermeasures服务贸易等项目对外支付税务备案表 | ||||||||||

| Serial number:编号 | ||||||||||

| 1、General Information(completed by the Remitter)基本情况(由支付人填写) | ||||||||||

| Domestic remitter境内支付人 | Remitter's name机构名称或个人姓名 | |||||||||

| Remitter's registration number纳税识别号 | ||||||||||

| Remitter's address地址或住所 | ||||||||||

| Remitting bank付汇银行 | Remitter's account number付汇账号 | |||||||||

| Contact person联系人 | Contact number联系电话 | |||||||||

| Overseas Beneficiary境外收款人 | Beneficiary's name名称 | Tax Jurisdiction名称所属国家或地区 | ||||||||

| Beneficiary's address地址 | Affiliated relationship境内外机构是否关联 | |||||||||

| Beneficiary's Bank收汇银行 | Beneficiary's account numbe收汇账号 | |||||||||

| Contract合同名称 | Contract Number合同号 | |||||||||

| Contract Amount(Or Terms of Payment)合同总金额(或支付标准) | Currency type of contract币种 | |||||||||

| Amount Paid已付金额 | Currency type of the account paid币种 | |||||||||

|

||||||||||

| Terms of contract(YYYY/MM/DD)合同执行期限 | 自Y年M月D日 至Y年M月D日 |

|||||||||

| Declaration声明 | I hereby declare that the information provided is complete and accurate to the best of my knowledge, in case of any falsehood, I commit to undertake the corresponding legal responsibilities.我谨在此声明:以上呈报事项准确无误,如有不实,愿承担相应的法律责任。 Signature or Stamp of Applicant:__________备案人签名或盖章 |

|||||||||

| 2、Notification告知事项 | ||||||||||

| This form is only apply to the Tax Filling Administration concerning Outbound Payment under Service Trade and Their Countermeasures. Remitter or Beneficiary should file tax return or give an illustration to the State Administration of Taxation and the Local Tax Bureau. If there is anything reverse, the tax authority shall deal with pursuant to relevant provisions of laws and regulations.本表仅适用于服务贸易等项目对外支付税务备案。以上付汇金额应向主管税务局进行纳税申报或做出必要说明。上述呈报如有不实,主管税务机关有权依据税收法律法规及相关规定进行处理。 Official Stamp主管税务机关盖章 Y年M月D日 |

||||||||||

|

【Notes for guidance】 1、The "Amount Paid" column fills in the total amount of exchange paid since the first payment is made under the same contract involving multiple outbound payment. 2、The form in triplicate, one for the Applicant, and one for tax authority. 3、In case of the outbound payment item only has the transaction receipt or agreement, "Contract" column should fill in the relevant receipt or the agreement name, "Contract Number" column is not indispensable. 【表单说明】 说明:1、"已付金额"一栏填写在同一合同项下涉及多笔对外支付时,办理第一笔支付之日起至今已支付的外汇总金额。 2、本表一式两份,一份交备案人,一份留存税务机关。 3、对外支付项目仅有交易凭证或协议的,"合同名称"一栏应填写相关凭证或协议的名称,"合同号"一栏可不填。 |

||||||||||

- 个人所得税年度自行纳税申报表(A表)Individual Income Tax Annual Self Tax Return (Form A)

- 个人所得税年度自行纳税申报表(B表)Individual Income Tax Annual Self Tax Return (Form B)

- 个人所得税年度自行纳税申报表(简易版)Individual Income Tax Annual Self Tax Return (Lite Version)

- 个人所得税年度自行纳税申报表(问答版)Individual Income Tax Annual Self Tax Return (Q&A Version)

- 个人所得税减免税事项报告表Information Reporting Form of Individual Income Tax(IIT) Deduction and Exemption

- 个人所得税专项附加扣除信息表Instructions on Filling the Information Form of Individual Income Tax Special Additional Deducti

- 境外所得个人所得税抵免明细表The Schedule of Individual Income Tax Credit for Foreign Sourced Income

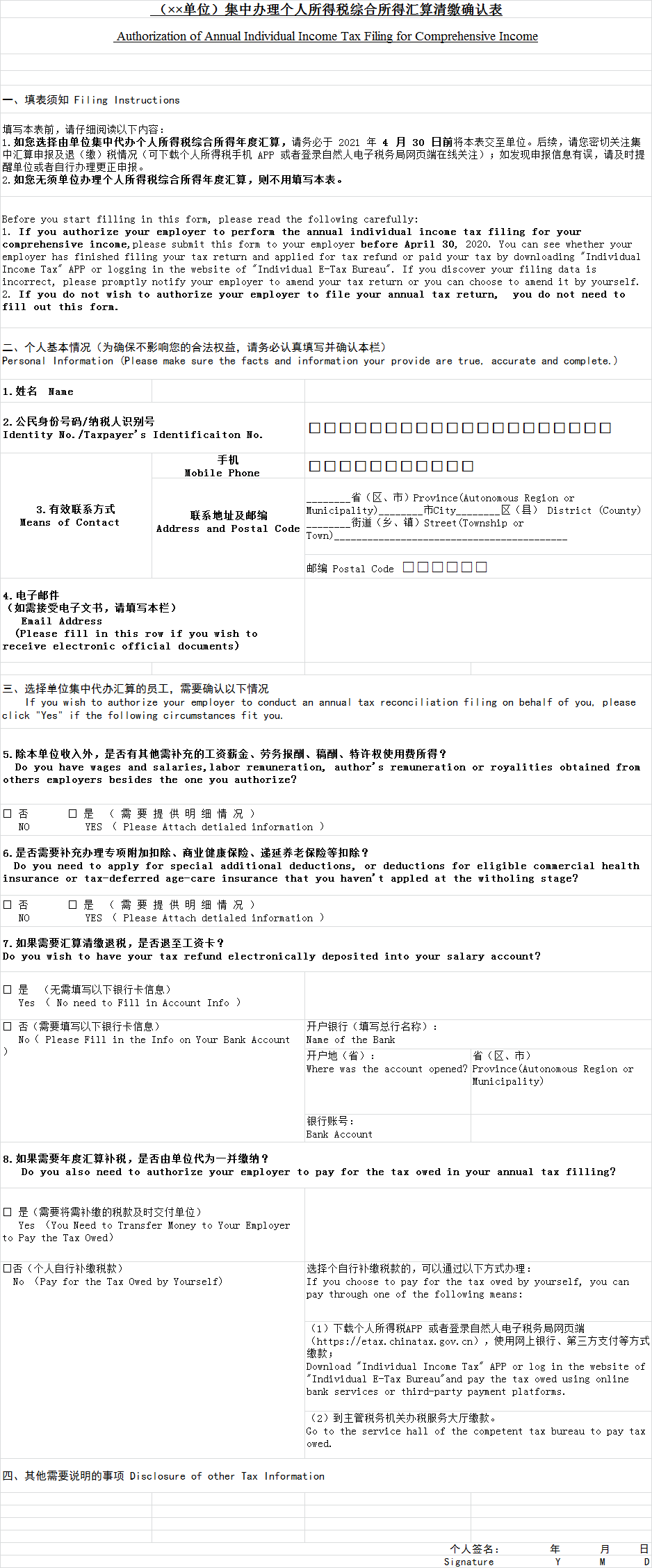

- 集中办理个人所得税综合所得汇算清缴确认表Authorization of Annual Individual Income Tax Filing for Comprehensive Income