Dear taxpayers:

We have sorted out ten common problems in the preparation process of related party transactions reporting and transfer pricing documentation; moreover, the frequently misfiledformsof related party transaction reporting areillustrated for you to better prepare the filings of related party transactions and transfer pricing documentation. Taxpayers are recommended to make online-filing of related party transactions reporting if the criteria have been met (please refer to Question 3 for the details) after completing the Annual Corporate Income Tax Filings for year 2020. During the reporting, taxpayers may refer to the appendix named

A.FAQs for Related Party Transactions Reporting

1. What are the tax law and policies applicable to the Reporting of Related Party Transactions and preparation of Transfer Pricing Documentation?

A:

2. What are the legal liabilities in concern of failing to Report the Related Party Transactions?

A:Article62 of

Article 44 of

3. What kind of enterprise is required to Report Related Party Transactions?

A: The following enterprises shall report the Related Party Transactions:

1) A tax resident enterprise which pays Corporate Income Tax according to its financial records and haves dealings with related parties during the filing year.

2)A non-tax resident enterprise which has an establishment or a place of business in China and settles Corporate Income Tax based on its actual accounts and haves dealings with related parties during the filing year.

3) Tax resident enterprises that prepare and submit the Country-by-Country Report according to the requirements of Article 5 of Notice No .42 of the STA, shall submit the < Information of Reporting Enterprise Form>of < Forms for Related-Party Transactions > and the 6 forms of Country-by-Country Report , even if they do not have dealings with related parties during the filing year.

4.What are the criteria for determination of related party relationship?

A:Any of the following relationships of an enterprise with other enterprises, organizations or individuals shall constitute a “related party relationship” as specified in Notice No .42 of the STA:

1) One party directly or indirectly owns 25% or more shares of the other party;or bothparties owned directly or indirectly 25% or more of shares by a common third party.

Where one party indirectly holds the other party’s shares through an intermediate party, so long as it owns 25% or more shares of the intermediate party, the percentage of the other party’s shares held by it is equal to the percentage of the other party’s shares held by the intermediate party.

Where two or more natural persons, who are spouses, related by lineal consanguinity, siblings, or in other custodianship/family maintenance relationships, hold the shares of the same enterprise, the percentage of shares held by them shall be aggregated in the calculation to determine related party relationship.

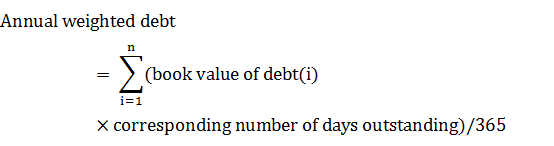

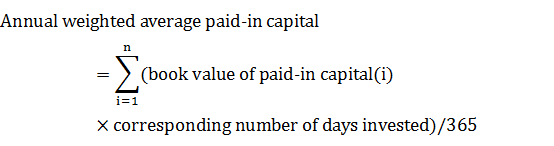

2) When one party owns the shares of the other party, or a common third party owns the shares of both parties, even though the percentage of shares held in either situation is less than the percentage as specified in item (i), the debt between both parties accounts for more than 50% of either party’s total paid-in capital, or more than 10% of one party’s total debt is guaranteed by the other party (except for loans or guarantees between independent financial institutions). Ratio of total debt to paid-in capital = annual weighted average debt / annual weighted average paid-in capital, where:

3) One party owns shares of the other party, or a common third party owns shares of both parties, even though the percentage of shares held in either situation is less than the percentage as specified in item a), the business operations of one party depend on the proprietary rights, such as patents, non-patented technological know-how, trademarks, copyrights, etc., provided by the other party.

4) One party owns shares of the other party, or a common third party owns shares of both parties, even though the percentage of shares held in either situation is less than the percentage as specified in item a), the business activities, such as purchases, sales, receipt of services, provision of services, etc., of one party are controlled by the otherparty.

The aforementioned ‘controlled’ refers to the case where one party has the right to make decisions on the other party’s financial and operational policies and can therefore derive benefits from the other party’s operations.

5) More than half of the directors or senior management (including secretaries of the board of directors of listed companies, managers, deputy managers, financial controllers and other personnel specified in the company’s articles of association) of one party are appointed or assigned by the other party, or simultaneously serve as directors or senior management of the other party; or more than half of the directors or senior management of both parties are appointed or assigned by a common third party.

6) Two natural persons who are spouses, related by lineal consanguinity, siblings, or inothercustodianship/family maintenance relationships have one of the relationships as specified in items(i) to (v) with one party and the other party respectively.

7) Two parties substantially have common interests in otherways.

Except for item b) in this Article, the aforementioned related party relationship should berecognized for the period during which it exists, in the event it changes during the filing year.

Exemption rule: Any shareholding by the State or association through assignment of directors or senior managementbythestate-ownedassetsmanagementauthorities,andthereforqualifiedastherelationship as specified in Items a) to d) of Article 2, will not be deemed to constitute a ‘related party relationship.

5.Which related party transactions are require to be declared?

A:According to Notice No .42,enterprise should declare the followingrelated party transactions.

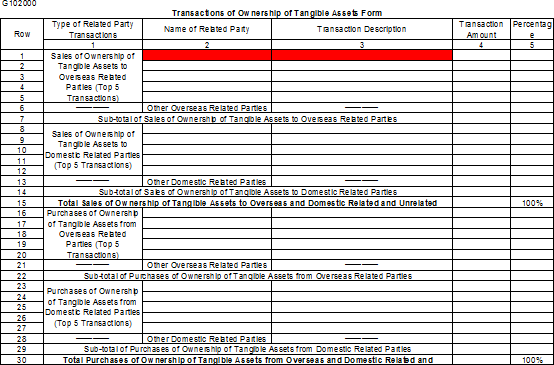

1) Transfer of the right to use or ownership of tangible assets. Tangible assets include merchandise, products, buildings, transportation vehicles, machinery and equipment, tools, apparatus, etc.

2) Transfer of financial assets. Financial assets include accounts receivables, notes receivables, other receivables, equity investments, debt investments, derivative financial instruments, etc.

3) Transfer of the right to use or ownership of intangibles. Intangibles include patents, non-patented technological know-how, trade secrets, trademarks, brand names, customer lists, sales channels, franchise rights, government licenses, copyrights, etc.

4) Financing. Financing includes all types of long-term and short-term loans (including group’s cash pool), guarantees, all types of interest-bearing advance payments and deferred receivables or payables, etc.

5) Services. Services include market survey, marketing planning, agency, design, consulting, administrative services, technical services, contract research and development, maintenance services, legal services, financial services, audit, recruitment, training, centralized procurement, etc.

6. What kind of resident enterprise is required to file the Country-by-Country Report?

A: Tax residententerprisesthatfallintoanyofthefollowingcategoriesshallfiletheCountry- by-Country Report at the time of submitting their Annual Related Party Transactions Reporting Forms:

1) The resident enterprise is the ultimate holding company of a multinational enterprise’s group having total consolidated group revenue of more than 5.5 billion RMB during the fiscal year immediately preceding the reporting fiscal year as reflected in its consolidated financial statements for such preceding fiscalyear.

Ultimate holding company is the enterprise that can consolidate the financial statements of all constituent enterprises that belong to its multinational enterprise group and cannot be included in the consolidated financial statements of another enterprise.

Constituent enterprises shall include:

Anyenterprisethatisincludedintheconsolidatedfinancialstatementsofthemultinationalenterprise group.

Any enterprise would be included in the consolidated financial statements of themultinational enterprise group, if equity interest in such enterprise were traded on a public securities exchange.

Any enterprise is excluded from the consolidated financial statements of the multinational enterprise group solely on size or materialitygrounds.

Any permanent establishment that prepares a separate financialstatement.

2) The resident enterprise that has been appointed by the MNE group to file theCountry-by-Country Report.

The Country-by-Country Report is to disclose information relating to the global income, taxes and business activities of all constituent enterprises of the multinational enterprise group to which the ultimate holding company belongs on a country-by-country basis.

7. What are the methods for the declaration of Forms for Related-Party Transactions?

A: There are two ways for enterprise to make declaration of Related-Party Transactions: electronic tax bureau (e-Filing) and door-to-door declaration. In order to save your time, Taxpayers are encouraged to take the priority of electronic tax bureau (e-Filing) for declaration. It can also be processed through the electronic tax bureau, if submitted forms are needed to be corrected.

The e-Filing process is as below: login the website of Guangdong Provincial Tax Service, STA( https://www.etax-gd.gov.cn/ )via internet, after entering the website, click on the top main column "Apply for Tax Issue", then click on "Declaration and Tax-paying", the system will be converted to "Declaration", click on the left side of the interface" Declaration List "-"Other Declaration", the form declarationinterface named “Other Declaration” will be show automatically on the right side. Drop-down menu to the end, select item 28" Annual Reporting Forms for Related-Party Transactions ", click fill out the declaration form. For detail process of the declaration, please refer to "Processing guidelines for e-Filing of Related-Party Transactions by Guangdong Provincial Tax Service, STA ". The filling form examples, please refer to” Examples and Key Points of Annual Reporting Forms for Related-Party Transactions (2016version) by Guangdong Provincial Tax Service, STA ”

The correction of e-Filing is as follows: Apply for Tax Issue-Declaration and Tax-paying -Declare correction, please select the corresponding Forms for Related-Party Transactions to correct the declaration.

B.FAQs for Transfer Pricing Documentation

8. What kind of enterprise is required to prepare the transfer pricing documentation?

A: Transfer Pricing Documentation includes master file, local file and special issue file. Enterprise should make cross-reference to the thresholds in respect of each kind of document, as long as one of the threshold is meet, the corresponding Transfer Pricing Documentation are required to be prepared. Thus, enterprise may need to prepare multiple Transfer Pricing Documentations simultaneously. For more FAQs for Transfer Pricing Documentation, please refer to “The Question-and-Answer to the Regulations on Related Party Transactions Reporting and Transfer Pricing Documentation, by Guangdong Provincial Tax Service, STA”

1) Enterprise that shall prepare a master file

Any enterprise that meets one of the following criteria shall prepare a master file

a) The enterprise that has conducted cross-border related party transactions during the tax year concerned,and the MNE group to which the ultimate holding company that consolidates the enterprise belongs,has prepared a masterfile.

b) The annual total amount of the enterprise’s related party transactions exceeds 1 billion RMB.

2) Enterprise that shall prepare a local file

Anyenterprisethatmeetsoneofthefollowingcriteriaduringthefiscalyearshallprepare a localfile:

a) The annual related party transfer of ownership of tangible assets exceeds 200 million RMB(for toll manufacturing transaction, the amount is calculated using the import/export customs declaration prices).

b) The annual related party transfer of financial assets exceeds 100 millionRMB.

c) The annual related party transfer of ownership of intangibles exceeds 100 million RMB.

d) The annual total amount of other related party transactions exceeds 40 million RMB.

Furthermore, as stated in Article 28 of the Notice No .42 of the STA, enterprises engaged in simple manufacturing such as toll processing or processing with imported materials, simple distribution or contract research and development, if losses are incurred, they should prepare local file for the loss year whether or not the criteria for preparing Transfer Pricing Documentation stated in Notice 42 are met.

3) Enterprise that shall prepare a local file

Specialissuefilesincludespecialissuefileoncostcontributionagreementsandspecial issue file on thin capitalization.

1) An enterprise that enters intoor implements a cost contribution agreement shall prepare a special issue file for the cost contribution agreement.

2) An enterprise with a related party debt-to-equity ratio exceeding the threshold shall prepare a special issue file on thin capitalization to demonstrate its conformity with the arm’s lengthprinciple.

4) Enterprise that exempted from preparing Transfer Pricing Documentation

If an enterprise meets one of the following criteria, it may be exempted from preparing all or part of Transfer Pricing Documentation.

1) Enterprises with effective advance pricing agreements in place may choose not to prepare local file and special issue file with respect to the related party transactions covered by such advance pricing agreements,and the amount of these related party transactions is excluded from the calculation of the thresholds stipulated in Articles 13 of Notice No .42.

2) Enterprises with only domestic related party transactions may choose not to prepare master file, local file and special issuefile.

9. What is the timing for enterprises to prepare the transfer pricing documentation?

A: A master file shall be completed within 12 months of the fiscal year end of the ultimate holding company of the enterprise group;local file and special issue file shall be completed by 30 June of the year following the year during which the related party transactions occur.

Transfer Pricing Documentation shall be submitted within 30 days after receiving a request from the taxadministrations.Taxpayers may also take the initiative to submit the Transfer Pricing Documentation to the tax administrations in time of completion. Enterprises that fail to submit Transfer Pricing Documentation due to an event of force majeure shall submit the Transfer Pricing Documentation within 30 days after the event of force majeure ceases to prevent thesubmission

10. What are the requirements for retention of transfer pricing documentation?

Transfer Pricing Documentation shall be kept for 10 years from the completion date of the preparation as required by the taxadministrations. In the event of merger or divestiture,the relevant Transfer Pricing Documentation shall be kept by the surviving enterprise after the merger ordivestiture.

3. Error-prone of Forms for Related-Party Transactions

1) Interval relationship in-between

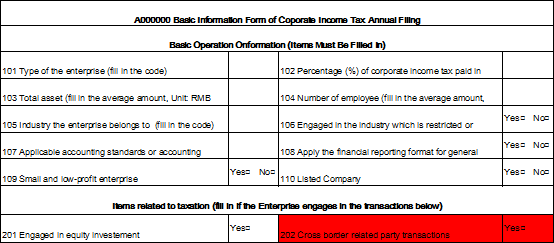

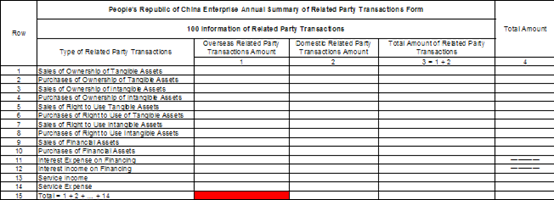

Taxpayers should pay attention to “item 202” of < A000000> when preparing annual corporate income tax returns. If select “yes”, it means that there are transactions with overseas related enterprises in this year, correspondingly, “Overseas Related Party Transactions Amount” of

2) Toll manufacturing transaction should be filled in

If the taxpayer have toll manufacturing transactions with overseas related party, the amount of the related party transaction shall be filled in

3) If changing of the balance of borrowed or lent of related party financing within the year, the changing shall be regarded as a new related party rights or liabilities, each transaction balance of which shall be filled in

(1) Taxpayer shall fill in each amount of borrowed or lent funds. If part of the borrowed (lent) funds are repaid (recovered) within the year, the remaining borrowed (lent) funds shall be regarded as a new related party debt (creditor's rights) and need to be re-filled in.

(2) Column 6 ”Amount of Overseas Related Party Transactions (Interests)” and column 7” Amount of Domestic Related Party Transactions (Interests)” include the following items: interest actually charged for direct or indirect acquisition of debt investment of related party, guarantee fee or mortgage fee of debt investment of related party that paid to related party, interest reclassified by special tax adjustment, financing cost of financial lease, nominal interest on financial derivatives or agreements of debt investment of related party, exchange gains and losses arising from acquirement of debt investment of related party and other expenses of interest nature.

4) Error-prone of

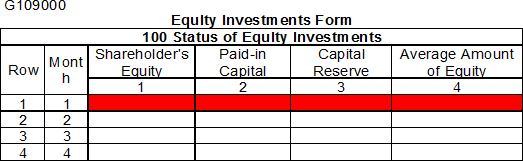

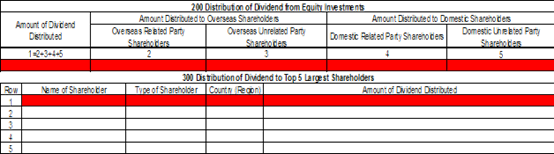

(1) Pay attention to the material differences when filling in different parts of the form, columns 1,2 and 3 are figures on "average of the balance of the beginning of the month plus the end of the month ", And the fourth column "Average Amount of Equity Investments" should fill in the largest amount of the following three figures: "owner's equity amount "," paid-in capital (equity)+ the sum of capital reserves "," paid-in capital (equity)" .

(2) 200 Dividend from Equity Investments, Distribution of dividend and 300 Dividend from Equity Investments, Distribution of Dividend to Top 5 Largest Shareholders, should fill in the numbers of ”the amount of profit distribution or dividends, bonuses announced by shareholders meeting in the reporting year”, not the numbers of amount actually distributed.

5)

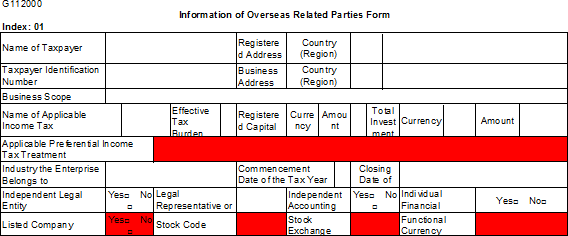

6) Error-prone of < Information of Overseas Related Parties Form>

(1) “Effective tax burden”= the amount of tax of income tax nature that paid (less all kinds of tax returns)÷the taxable income of income tax nature×100%.

(2) "ApplicablePreferential Income Tax Treatment" shall be reported the followings: the tax preference of income tax nature that enjoyed by overseas related parties in the located country (including additional deductions, reduced income, tax return, tax rate or tax relief, etc.) , the preference other taxes shall not be reported.

(3) If an overseas related party belongs to a "listed company ", the" stock code "and" stock exchange "columns are required.

(4) The "Functional Currency" column is to fill in the currency that actually applicable to overseas related party for book keeping.

(5) Taxpayer shall check the < Information of Overseas Related Parties Form> for completeness, preventing the trouble of declaration failure.

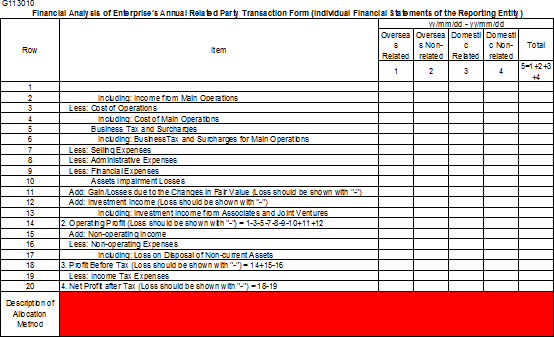

7) “Description ofAllocation Method” column of < Financial Analysis of Enterprise's Annual Related Party Transaction Form > must be filled in classification standard of cost and expense

When filling in the < Financial Analysis of Enterprise's Annual Related Party Transaction Form > (including individual statements and consolidated statements), taxpayer shall give clear indication of allocation methods of costs, expenses that can be accurately divided and of other methods using to allocate the costs, expenses that cannot be accurately divided.

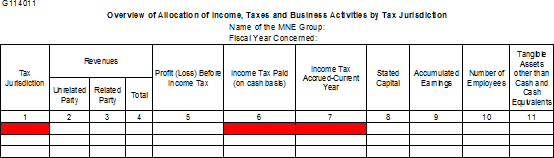

8.Taxpayers who meet the criteria for Country-by-country Report should fill in the grid by summarizing group member entities by country or region. If member entities are not resident enterprise in any country (region), in this case, this shall be summed and filled in a separate line as no country (region) summary. The filling-in requirements of “corporate income tax actually paid (cash basis)” and “accrued corporate income tax within the year” are different. The former is the total amount of corporate income tax that actually paid by all member entities in the same country or region, and the latter is the total amount of current corporate income tax calculated on the basis of taxable income within the year by all member entities in the same country or region.